iowa capital gains tax real estate

Therefore you would owe 2250. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate.

Tds Statement U S 194 Ia Now Rectifiable Taxworry Com Statement Capital Gains Tax Transfer Pricing

Taxes capital gains as income and the rate reaches 853.

. Your tax rate is 0 on long-term capital gains if. Notice these rates are much lower than normal federal income tax brackets. Iowa however does.

In fact the same income tax rates apply to all Iowa taxable income whether stemming from ordinary income or a capital gain. Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate. That applies to both long- and short-term capital gains.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Should the Department request it the information on the Capital Gain Deduction Checklist will be needed to verify whether you qualify for the deduction.

In our example the sale price of this stock is 50 and the original cost basis is 10. The long-term capital gains rate is 15 for single filers with taxable incomes between 40401 and 445850 and for couples filing jointly with incomes between 80801 and 501600. There is currently a bill that if passed would increase the.

Take the purchase price of the home. You will owe capital gains taxes on the 40 that you made from this transaction. A Like-Kind Exchange with a conservation agency might help you protect land while deferring capital gains taxes.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Hawaii taxes capital gains at a lower rate than ordinary income. When a landowner dies the basis is automatically reset to the current fair market value at the time of death.

Moreover the deduction could not exceed 17500 for the tax year. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction. A guide to capital gains tax alternatives Item Preview remove-circle Share or Embed This Item.

Most property except your main residence home is subject to capital gains tax. Iowa has a unique state tax break for a limited set of capital gains. Individuals earning between 40001 to 441450 and married couples filing jointly making 80001 to 496600 face a 15 capital gains tax.

These numbers rose slightly for the year 2021. The highest rate reaches 11. The Combined Rate accounts for Federal State and Local tax rates on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction on qualifying capital gains as specified in a. At 22 your capital gains tax on this real estate sale would be 3300. Additional State Capital Gains Tax Information for Iowa.

Consequently Iowa would tax the capital gain from a typical stock sale at a rate of 898 percent the rate that applies to an individuals taxable income exceeding 69255 for tax year 2015. This is the sale price not the amount of money you actually contributed at closing. You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return.

The long-term capital gains rate is 15 for single filers with taxable incomes between 40401 and 445850 and for couples filing jointly with incomes between 80801. The real estate has to have been held for ten years and. These rates are typically much lower than the ordinary income tax rate.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two stiff tests. Hawaiis capital gains tax rate is 725.

Iowa allows taxpayers to deduct federal income taxes from their state taxable income. The sale price how much you sold the asset for and the original cost basis how much you bought it for. Additional State Capital Gains Tax Information for Iowa.

Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate of 20. Cost of the purchaseincluding transfer fees attorney fees inspections but not points you paid on your mortgage. When you sell a property that youve lived in for at least two of the last five years you qualify for the homeowner exemption also known as the Section 121 exclusion for real estate capital gains taxes.

One of the County Treasurers responsibilities is to collect taxes for real estate property manufactured homes utilities bushels of grain monies and credits buildings on leased land and city and county special assessments including delinquent sewer rental and solid waste rates and charges for all tax levying. 3 Above those incomes the rate is 20. If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent.

The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Single homeowners pay no capital gains taxes on the first 250000 in profits from the sale of their home. In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis.

Other information in addition to that shown on the checklist may also be required in some situations. Selling real estate without paying taxes. At 22 your capital gains tax on this real estate sale would be 3300.

Two prices are involved in establishing a capital gain tax. Your income and filing status make your capital gains tax rate on real estate 15.

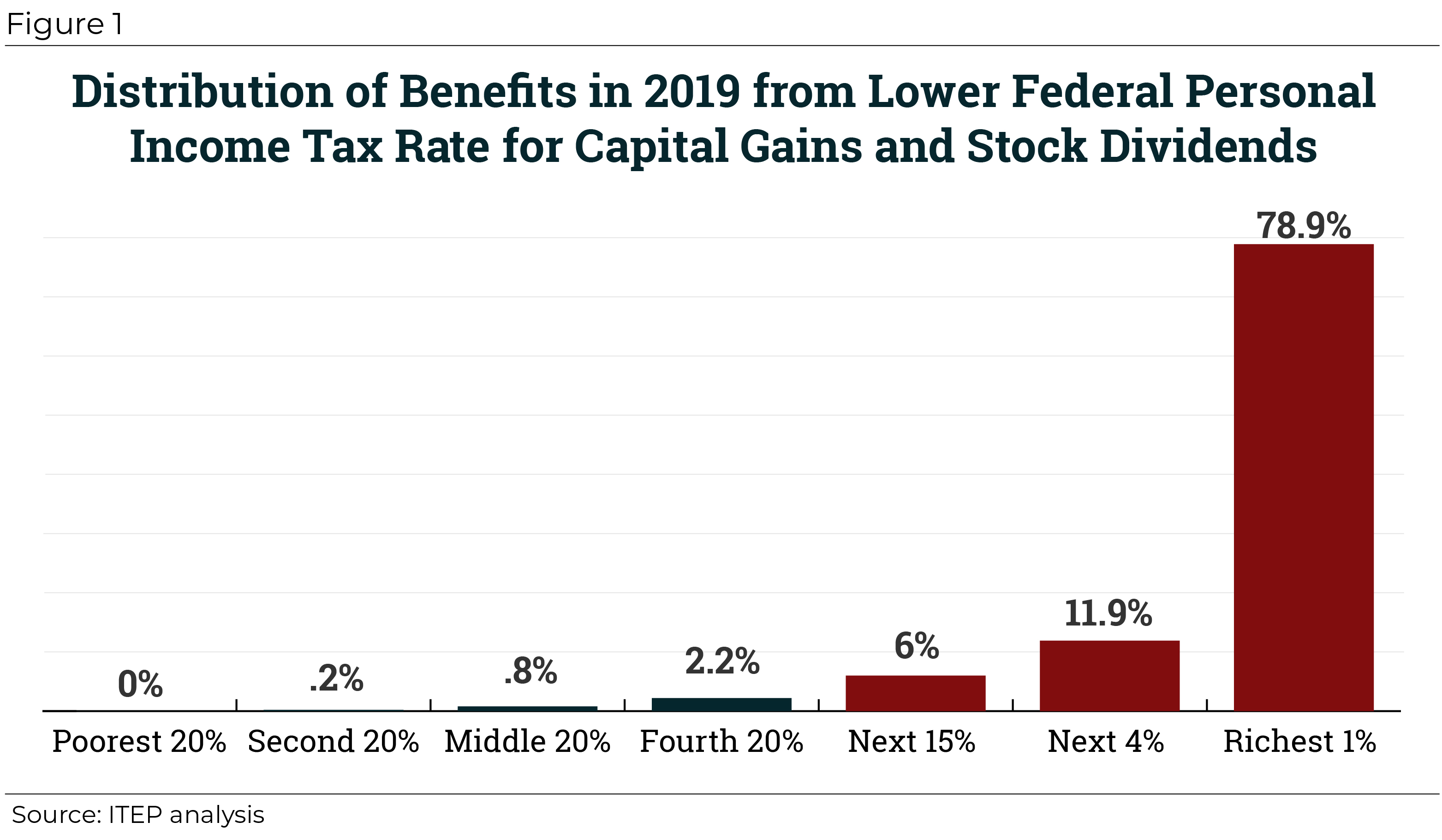

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax Iowa Landowner Options

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax On Property Development Projects Developer Explains

2021 Capital Gains Tax Rates By State Smartasset

Can You Avoid Capital Gains Tax In Nebraska Element Homebuyers

How To Calculate Capital Gain Tax On Sale Of Land Abc Of Money

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

How High Are Capital Gains Taxes In Your State Tax Foundation

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

How To Pay 0 Capital Gains Taxes With A Six Figure Income

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax On Real Estate And How To Avoid It

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Tax Deductions Sale